Since the introduction of Ordinals onto the Bitcoin network in January 2023 there has been criticism of them clogging up the network and resulting in higher fees for users. Large image files are often shown as examples of taking the majority of the size of a block but there are a large number of text based ordinals which consume significantly less space.

I consider the transactions per second throughput of the Bitcoin network from 2021 to the present to establish if ordinals were impacting the network.

Originally I intended only to consider 2022 and 2023 but on an initial review of the data the results were unexpected; the throughput was greater in 2023 despite ordinals being introduced. This is discussed later.

Mean Transactions Per Second

| Month | 2021 | 2022 | 2023 |

| January | 13.77 | 8.58 | 8.63 |

| February | 13.41 | 7.96 | 10.27 |

| March | 14.95 | 8.59 | 12.31 |

| April | 13.12 | 9.36 | 14.97 |

| May | 10.57 | 8.82 | 31.17 (Partial) |

| June | 9.84 | 8.73 | |

| July | 6.33 | 7.90 | |

| August | 7.12 | 8.41 | |

| September | 9.47 | 8.93 | |

| October | 8.90 | 7.42 | |

| November | 8.64 | 8.91 | |

| December | 8.72 | 8.86 |

Median Transactions Per Second

| Month | 2021 | 2022 | 2023 |

| January | 4.70 | 2.99 | 3.39 |

| February | 4.71 | 3.10 | 4.05 |

| March | 4.24 | 3.14 | 4.41 |

| April | 4.05 | 3.17 | 4.97 |

| May | 3.47 | 3.21 | 9.62 (Partial) |

| June | 2.85 | 3.12 | |

| July | 2.65 | 2.94 | |

| August | 2.82 | 2.98 | |

| September | 3.00 | 3.10 | |

| October | 3.25 | 3.08 | |

| November | 3.33 | 3.39 | |

| December | 3.18 | 3.17 |

To my surprise, the transactions per second have increased, on average, since the introduction of ordinals onto the Bitcoin network when compared to the same months in 2022. I extended my analysis to include 2021 to establish if this was consistent behaviour. The figures between 2023 and 2021 were more similar to that of 2022. I suggest that this is due to the bull market of 2021 vs the bear market of 2022 resulting in there being significantly fewer transactions on the network in 2022.

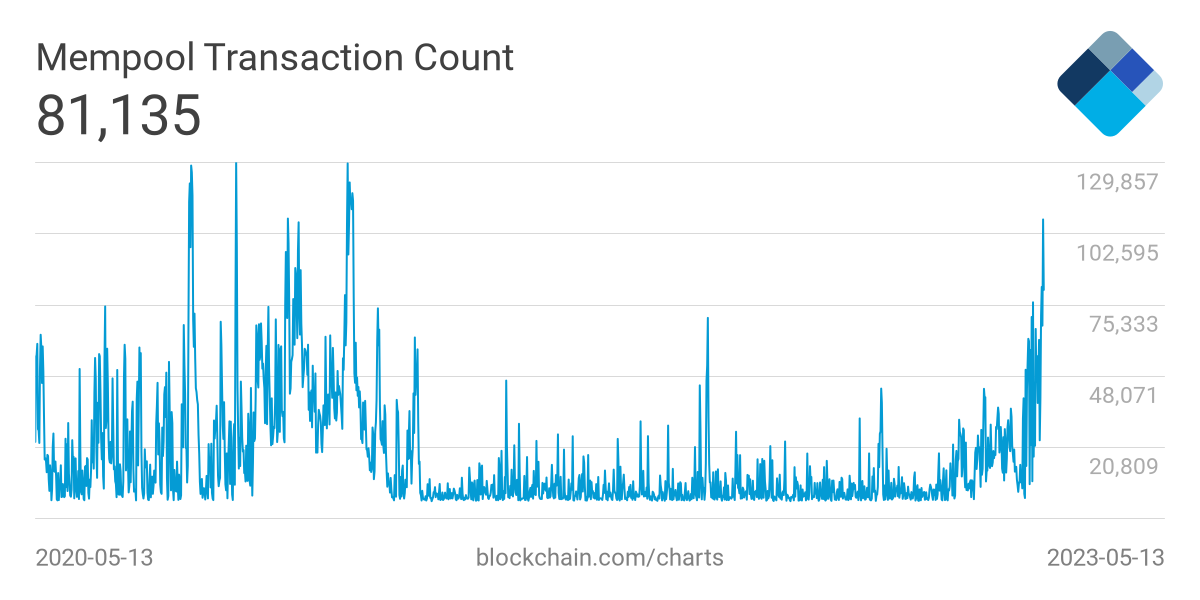

Reviewing the mempool transaction account chart on Blockchain.info lends support to this.

Considering the results, the conclusion appears to be that ordinals haven’t negatively impacted the transactions per second throughput of the Bitcoin network, however, it must be considered that this is during a bear market. If the ordinals remain popular during the next bull market where transaction volumes increase there is a realistic prospect of the network becoming saturated leading to higher transaction fees and longer waits for users before transactions are included in a block.

Note the above figures are based on inverting negative time values where a higher block is timestamped before the previous block. This is discussed in more detail in https://blockchainanalysis.co.uk/bitcoin-transactions-per-second-tps/. Furthermore, this is based on the embedded timestamps within the blocks which may not be accurate; see https://blockchainanalysis.co.uk/bitcoin-block-time-consistency/