Back in February last year I wrote about Bitcoin’s block reward halving and when block rewards may reduce to zero based on the projection of block time (https://blockchainanalysis.co.uk/bitcoins-final-block-reward/). In that post I touched upon the requirement for transaction fees to reach a point where miners continue to be incentivised to mine despite low or no block rewards. At the time of writing we are at block 825303 and the next block halving event is at block 840000 (14697 blocks time / around 100 days) and therefore I’ve been revisiting the data with this in mind.

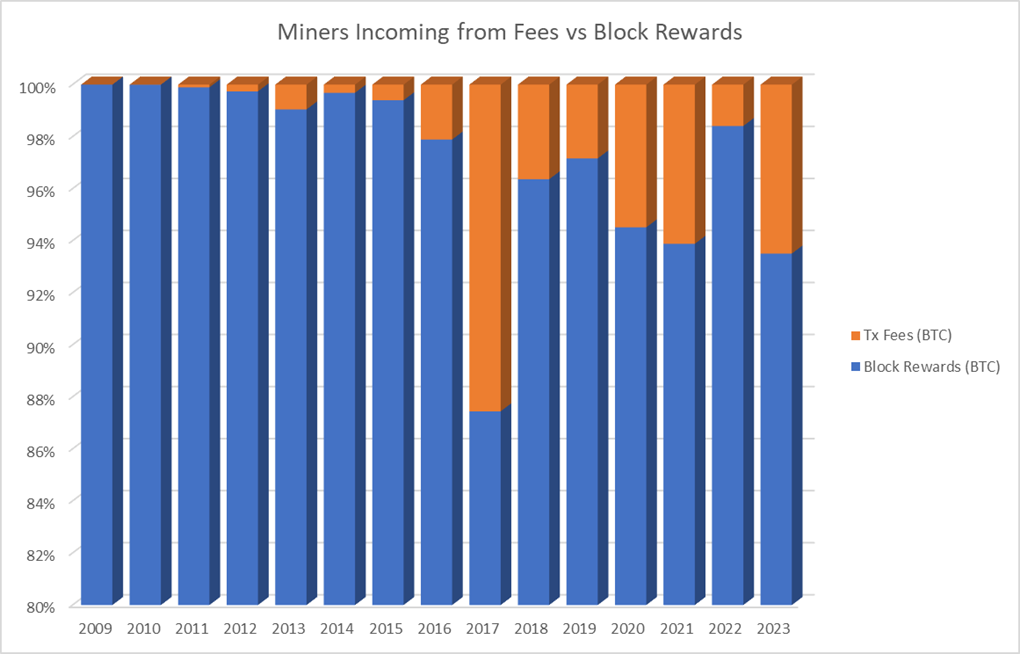

Between 2009 and 2015, transaction fees accounted for less than 1% of the miner’s rewards. From this point forward transactions fees have remained above 1%, peaking at an outlier in 2017 at 12.5%, I expect due to the bull market and limited/immature exchange options at that time. We have, however, seen an overall trend towards fees growing as a source of income for miners, something that will have to continue as the block rewards reduce.

The table below summarises the rewards afforded to miners since 2009 whilst the graph provides a visual representation of the same data (note the Y-Axis starts at 80% to better visualise the data).

| Year | Block Rewards (BTC) | Tx Fees (BTC) | Total (BTC) | Block Reward % | Fee % |

| 2009 | 1624450.00 | 2.87 | 1624452.87 | 100.00 | 0.00 |

| 2010 | 3396000.00 | 43.99 | 3396043.99 | 100.00 | 0.00 |

| 2011 | 2981350.00 | 3086.52 | 2984436.52 | 99.90 | 0.10 |

| 2012 | 2612225.00 | 6797.46 | 2619022.46 | 99.74 | 0.26 |

| 2013 | 1585825.00 | 15274.64 | 1601099.64 | 99.05 | 0.95 |

| 2014 | 1471625.00 | 4636.57 | 1476261.57 | 99.69 | 0.31 |

| 2015 | 1358025.00 | 8200.11 | 1366225.11 | 99.40 | 0.60 |

| 2016 | 1045862.50 | 22555.59 | 1068418.09 | 97.89 | 2.11 |

| 2017 | 699100.00 | 100370.69 | 799470.69 | 87.45 | 12.55 |

| 2018 | 681225.00 | 25704.82 | 706929.82 | 96.36 | 3.64 |

| 2019 | 677900.00 | 19787.71 | 697687.71 | 97.16 | 2.84 |

| 2020 | 453318.75 | 26309.78 | 479628.53 | 94.51 | 5.49 |

| 2021 | 329287.50 | 21461.93 | 350749.43 | 93.88 | 6.12 |

| 2022 | 332425.00 | 5374.73 | 337799.73 | 98.41 | 1.59 |

| 2023 | 337493.75 | 23431.57 | 360925.32 | 93.51 | 6.49 |

As Bitcoin gains monetary value it continues to be more a store of value then a currency, I therefore do not expect that transaction fees will play a significant role as there are (relatively) few transactions taking place and more trades are handled by exchanges (which maintain their own ledger). The SEC’s approval of several Bitcoin spot ETFs will certainly contribute to this as ownership by institutions increases and, like exchanges, private ledgers track the ownership.