Despite the pessimism over the valuation of crypto over the year (“just” ~156% return for BTC), crypto has not been devoid of substantial events in 2023. The headlines have been dominated by the prosecution and conviction of Sam Bankman-Fried, and this story will continue into 2024 when he is sentenced.

November 2023 saw Binance founder and vocal crypto Changpeng Zhao (often known as ‘CZ’) step down as CEO and faced criminal charges in the US. He subsequently pleaded guilty to money laundering violations and will also be sentenced in 2024.

We witnessed the collapse of Silicon Valley Bank, a ‘crypto friendly’ bank, with ties to Circle who are responsible for the USDC resulting in the repegging of the stablecoin.

The introduction of Bitcoin ordinals also occurred, along with the debate whether it is good or bad for Bitcoin.

In more positive news for crypto, the long-running case of SEC v. Ripple Labs finally concluded with the court determining that XRP was not a not a security when sold on exchanges to retail investors. A major ruling in the crypto space and one which will undoubtedly be cited in future cases.

The positivity continued over the last few weeks of the year with the long-awaited Bitcoin ETF (Exchange Traded Fund) approval looking imminent. Several applications are with the SEC and the decision is expected in early January 2024.

But how did Bitcoin perform over the year?

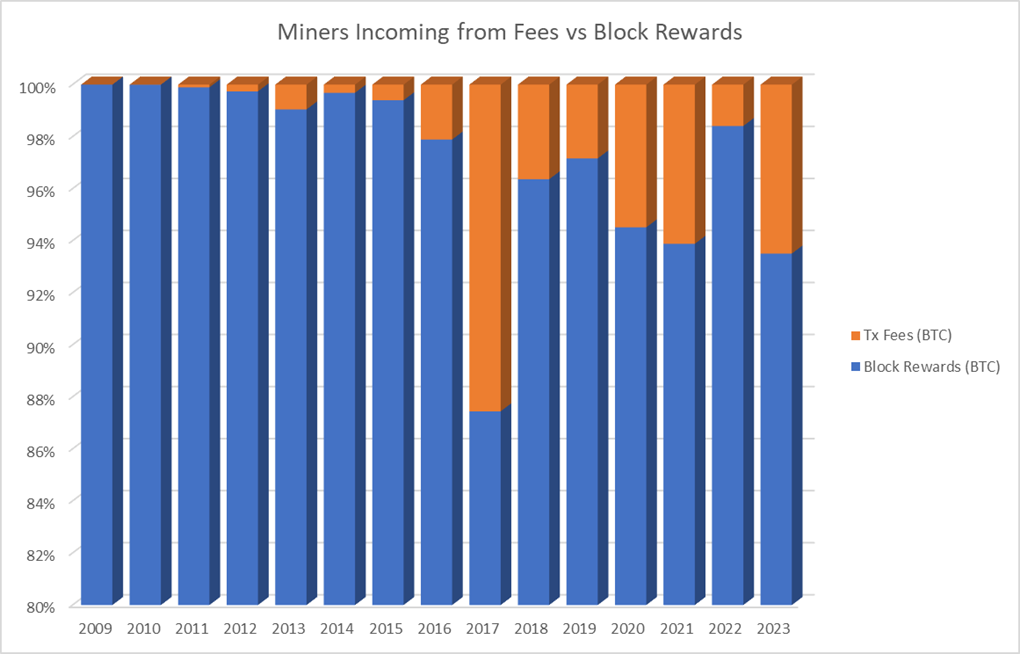

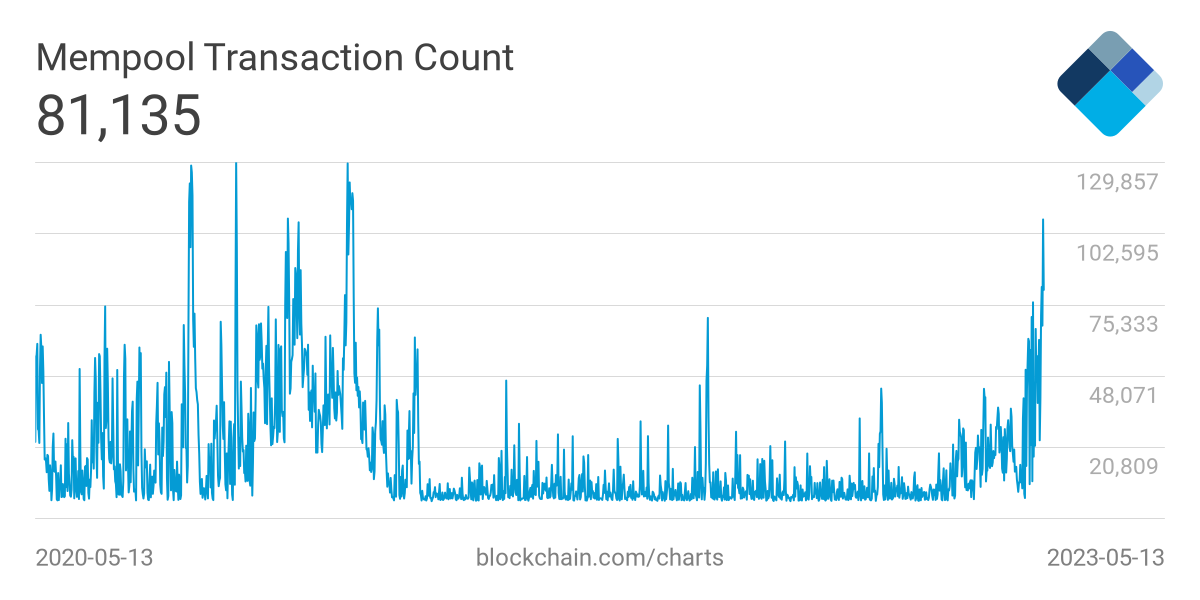

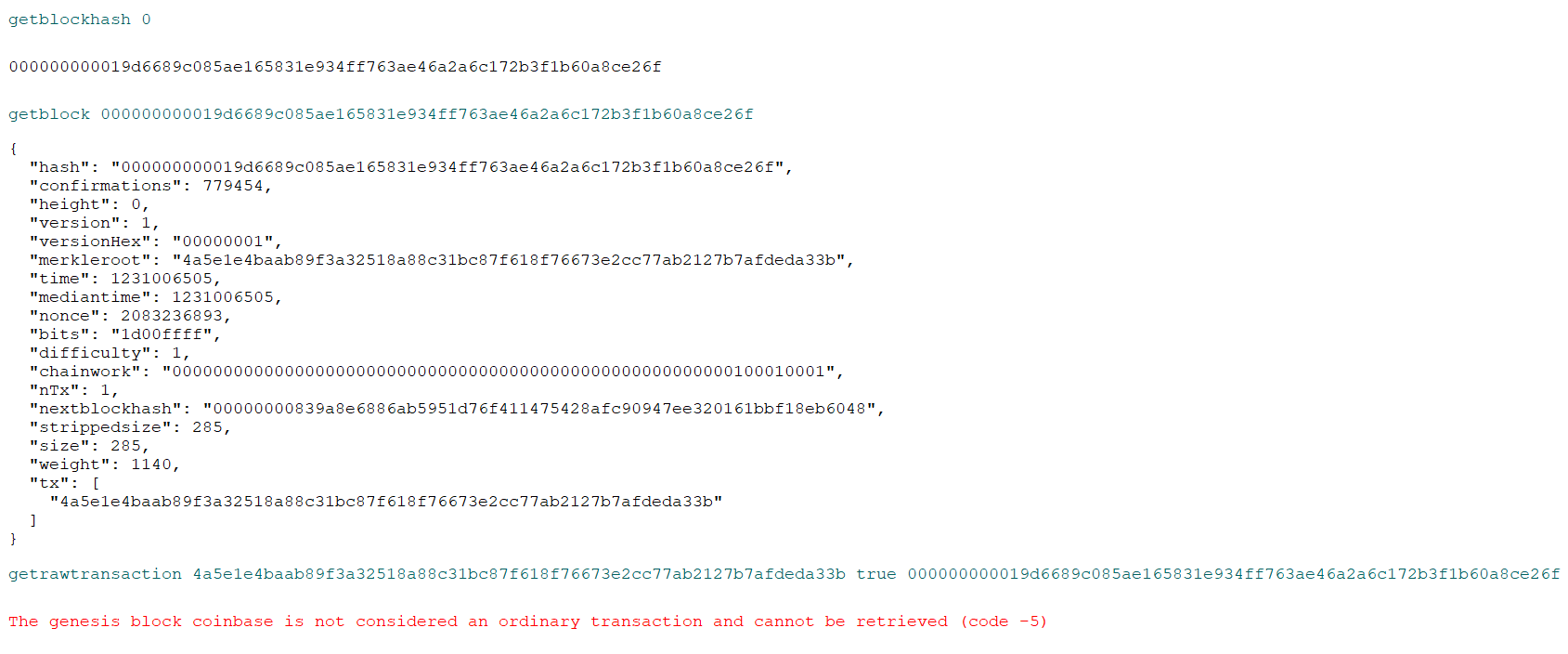

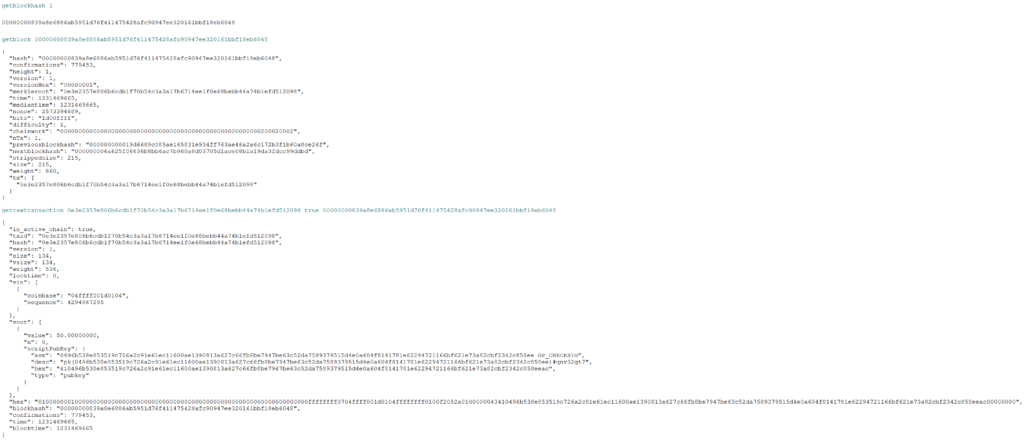

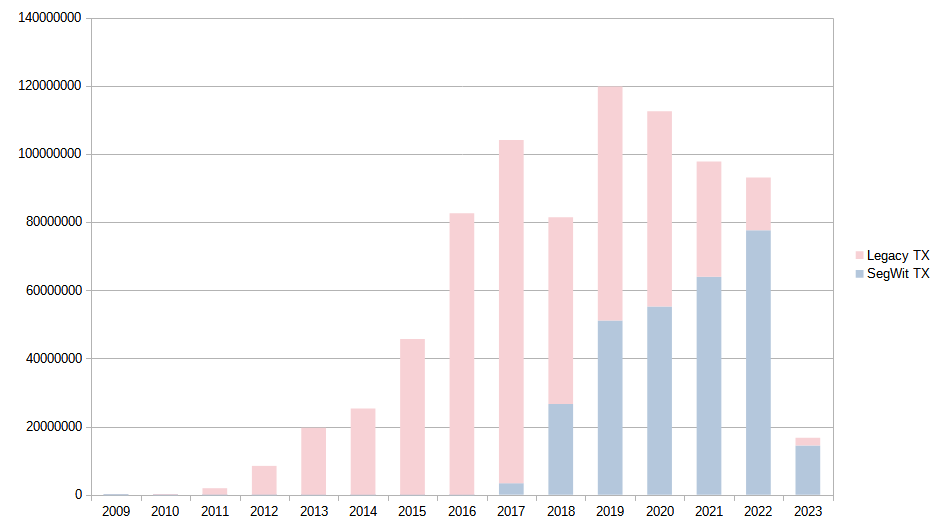

In 2023 there were 153,415,993 transactions (141,472,918 SegWit and 1,1943,075 non-SegWit) contained in 53999 blocks. This led to an increase of 71,730,195 in UTXOs (Unspent Transaction Outputs). The average block time was 584 seconds (9 minutes and 44 seconds). Miners were awarded 360,925.31 BTC over the year, consisting of 337,493.75 BTC in block rewards and 23,431.57 in fees. The largest fee paid was in block 818087 when a fee of 83.65 BTC was paid to send 55.77 BTC.

How did this compare to 2022?

In 2022 there were 9,3106,378 transactions in 53188 blocks leading to an increase of 7,469,033 UTXOs. The average block time was 593 seconds (9 minutes 53 seconds). Miners were awarded 337,799.73 BTC (332,425 BTC in block rewards and 5,374.73 BTC in fees). The largest fee paid was in block 767482 when a fee of 3.45 BTC to send just 0.27 BTC.

With big events coming early in 2024 it promises to be another action filled year for Bitcoin and the crypto community as a whole.